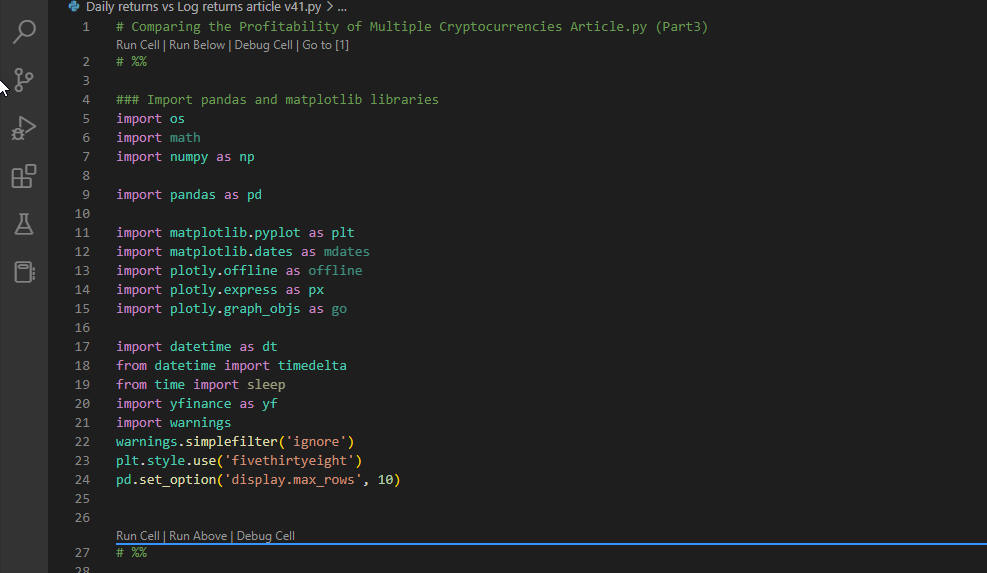

まずは、Visual Studio Codeを起動してプログラムファイルを作成する

Visual Studio Code (VS Code)を起動したら新規ファイル(*.py)を作成して行1-221をコピペします。

ここでは、Jupter NotebookのようにPythonのプログラムをセル単位で実行します。

VS Codeの場合は「#%%」から「#%%」の間がセルになります。

セルを選択したら[Ctrl + Enter」でセルのコードを実行します。

IPythonが起動されて「インタラクティブ」ウィンドウが表示されます。

「インタラクティブ」ウィンドウからはPythonのコードを入力して実行させることができます。

たとえば、「df.info()」を入力して[Shift + Enter」で実行します。

* Article.py:

# Comparing the Profitability of Multiple Cryptocurrencies Article.py

# %%

### Import pandas and matplotlib libraries

import os

import math

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

import matplotlib.dates as mdates

import plotly.offline as offline

import plotly.express as px

import plotly.graph_objs as go

import datetime as dt

from datetime import timedelta

from time import sleep

import yfinance as yf

import warnings

warnings.simplefilter('ignore')

plt.style.use('fivethirtyeight')

pd.set_option('display.max_rows', 10)

# %%

######################################################################################################################################

def load_data(symbol: str, start_date: dt.datetime , end_date: dt.datetime, period='1d', interval='1d', prepost=True) -> pd.DataFrame:

# valid periods: 1d,5d,1mo,3mo,6mo,1y,2y,5y,10y,ytd,max

# fetch data by interval (including intraday if period < 60 days)

# valid intervals: 1m,2m,5m,15m,30m,60m,90m,1h,1d,5d,1wk,1mo,3mo

try:

end_date = end_date + timedelta(days=1)

start_date_str = dt.datetime.strftime(start_date, "%Y-%m-%d")

end_date_str = dt.datetime.strftime(end_date, "%Y-%m-%d")

print(f"Loading data for {symbol}: start_date={start_date_str}, end_date={end_date_str}, {period=}, {interval=}")

df = yf.download(symbol, start=start_date_str, end=end_date_str, period=period, interval=interval, prepost=prepost)

# Date Open High Low Close Adj Close Volume Symbol : interval=1d,5d,1wk,1mo,3mo

# Datetime Open High Low Close Adj Close Volume Symbol : interval=1m,2m,5m,15m,30m,60m,90m,1h

# Add symbol

df['symbol'] = symbol

# Reset index

df.reset_index(inplace=True)

# Rename Date or Datetime column name to Time

if interval in '1m,2m,5m,15m,30m,60m,90m,1h':

df.rename(columns={'Datetime': 'Date'}, inplace=True)

else: # interval=1d,5d,1wk,1mo,3mo

df.rename(columns={'Date': 'Date'}, inplace=True)

# Convert column names to lower case

df.columns = df.columns.str.lower()

return df

except:

print('Error loading data for ' + symbol)

return pd.DataFrame()

############################################

def get_data(csv_file: str) -> pd.DataFrame:

print(f"Loading data: {csv_file} ")

df = pd.read_csv(csv_file)

# date,open,high,low,close,adj close,volume,symbol

df['date'] = pd.to_datetime(df['date'])

df.set_index(['date'], inplace=True)

return df

##############################

# Main

##############################

### Load the crypto data from yahoo finance

symbols = ['BTC-USD', 'ETH-USD','LTC-USD']

# symbols = ['OP-USD']

# symbols = ['HEX-USD']

# symbols = ['TWT-USD', 'AAVE-USD', 'RPL-USD']

# symbols = ['MATIC-USD', 'AXS-USD']

# symbols = ['FMT-USD', 'DOGE-USD', 'TRAC-USD']

interval = '1d' # 1m,2m,5m,15m,30m,60m,90m,1h,1d,5d,1wk,1mo,3mo

df_list = []

for symbol in symbols:

csv_file = f"data/csv/compare_crypto_20180101({symbol})_{interval}.csv" # data/csv/compare_crypto_yyyymdd(BTC_USD)_1d.csv

isFile = os.path.isfile(csv_file)

if not isFile:

if interval in '1m,2m,5m,15m,30m,60m,90m,1h':

end = dt.datetime.now()

start = end - timedelta(days=7)

else: # interval=1d,5d,1wk,1mo,3mo

start = dt.datetime(2018,1,1) # 2018,1,1 or 2020,1,1 or 2023,1,1 or 2023,2,1

end = dt.datetime.now()

# load_data(symbol: str, start_date: dt.datetime , end_date: dt.datetime, period='1d', interval={'1m'|'1d'}, prepost=True) -> pd.DataFrame:

df = load_data(symbol, start, end, period='1d', interval=interval)

if df.shape[0] > 0:

df.to_csv(csv_file, index=False)

# end of if not isFile:

df = get_data(csv_file)

df_list.append(df)

raw_df = pd.concat(df_list)

raw_df.dropna(inplace=True)

raw_df.isnull().sum()

# %%

### Filter close, symbol columns

close_df = raw_df.filter(['close','symbol'])

close_df.reset_index(inplace=True)

close_df.groupby('symbol')['date'].agg(['min', 'max', 'count'])

# %%

### pivot table

pivot_df = close_df.pivot_table(index=['date'], columns='symbol', values=['close'])

pivot_df.dropna(inplace=True)

pivot_df.isnull().sum()

# pivot_df

# %%

#### flatten columns multi-index, `date` will become the dataframe index

# col[0] col[1]

# pivot_df.columns.values => array([('close', 'BTC-USD'), ('close', 'ETH-USD'), ('close', 'LTC-USD')])

pivot_df.columns = [col[1] for col in pivot_df.columns.values] # ['BTC-USD', 'ETH-USD', 'LTC-USD']

# pivot_df

# %%

### Calculate log return & cumulative log return

cum_df = pivot_df.copy()

log_col_name_list = []

cum_col_name_list = []

for symbol in symbols: # BTC-USD, ETH-USD, LTC-USD

coin = symbol

log_col_name = f'log_return_{coin}' # log_return_xxx,...

log_col_name_list.append(log_col_name)

# Calculate log return

cum_df[log_col_name] = np.log(cum_df[symbol] / cum_df[symbol].shift(1))

# cum_df['log_return_xxx'] = np.log(cum_df['xxx'] / cum_df['xxx'].shift(1))

# Calculate cumulative log return

cum_col_name = f'cum_log_return_{coin}' # cumulative_log_return_btc

cum_col_name_list.append(cum_col_name)

cum_df[cum_col_name] = np.exp(cum_df[log_col_name].cumsum()) - 1

# cum_df['cum_log_return_xxx'] = np.exp(cum_df['log_return_xxx'].cumsum()) - 1

# Preview the resulting dataframe

print(f"Cumulative Log Return ({symbol}) = {cum_df.iloc[-1][cum_col_name]:.4f}")

# print(f"Cumulative Log Return (xxx) = {cum_df.iloc[-1]['cum_log_return_xxx']:.4f}")

### Replace np.inf or -np.inf (positive or negative infinity) with np.nan(Not A Number)

cum_df.replace([np.inf, -np.inf], np.nan, inplace=True)

cum_df.isnull().sum()

### Drop rows if np.nan (Not A Number)

cum_df.dropna(inplace=True)

cum_df.isnull().sum()

# %%

### Transforming the cumulative returns data for plotting.

cum2_df = cum_df.reset_index()

for i, symbol in enumerate(symbols): # BTC-USD, ETH-USD, LTC-USD

# replace close price with cumulative log return

cum2_df[symbol] = cum2_df[cum_col_name_list[i]]

# cum2_df['BTC-USD'] = cum2_df['cum_log_return_btc']

# %%

#### Drop coumuns : log_return_btc,cum_log_return_btc,log_return_eth,cum_log_return_eth,log_return_ltc,cum_log_return_ltc

column_list = cum2_df.columns.to_list()

# column_list

# column_list[len(symbols)+1:]

drop_column_list = column_list[len(symbols)+1:]

cum3_df = cum2_df.drop(drop_column_list, axis=1)

# cum3_df

# %%

cum4_df = cum3_df.melt(id_vars=['date'], var_name='symbol', value_name='cum_log_return')

cum4_df['cum_log_return_pct'] = cum4_df['cum_log_return'] * 100

# cum4_df

#%%

# Plot line

fig = px.line(

cum4_df,

x='date', y='cum_log_return_pct', # log_y=True,

color='symbol',

labels={'cum_log_return_pct':'cumulative log returns (%)', }

)

# Add chart title and axis labels

fig.update_layout(

title=f'Performance - Cumulative Log Returns: Interval({interval.upper()})',

xaxis_rangeslider_visible=True, # Set True or False

xaxis_title='Date'

)

fig.show()

図1

図1にはVS Codeの画面が表示されています。

次のステップでは「セル」を選択して「セル」単位でPythonのコードを実行します。

図1

図1にはVS Codeの画面が表示されています。

次のステップでは「セル」を選択して「セル」単位でPythonのコードを実行します。